interest tax shield là gì

Tax-Exempt Under this a person can avail tax benefit depending on tax filing status ie the category of Tax Payer and the number of dependents. Tax Shield Lá Chắn Thuế Định nghĩa Lá chắn thuế là khoản giảm thu nhập chịu thuế của một cá nhân hay doanh nghiệp đạt được thông qua công khai những khoản khấu trừ được phép như lãi thế chấp chi phí y tế đóng góp từ thiện và khấu hao.

Li Thuyết đanh đổi Tĩnh Static Trade Off Theory Stt La Gi

Leverage increases there is a trade-off between the interest tax shield and bankruptcy causing an optimum capital structure DE.

. Tax shield là gì. Định nghĩa khai niêm giải thích y nghia ví dụ mâu và hướng dẫn cách sử dụng Tax Shield - Definition Tax Shield - Kinh tế. As the debt equity ratio ie.

Interest tax shield là gì If firm has net financial expense then tax shield is subtracted from operating income. Thuế thương vụ hay thuế bán hàng là thuế tiêu thụ được chính phủ áp lên việc bán hàng hóa và dịch vụ. These deductions reduce a taxpayers taxable income for a given year or defer income taxes into future years.

For example using loan capital instead of equity capital because interest paid on the loans is generally tax deductible whereas the dividend paid on equity is not. Tax Shield Value of Tax-Deductible Expense x Tax Rate So for instance if you have 1000 in mortgage interest and your tax rate is. CAPM có những thành phần gì.

The top curve shows the tax shield gains of debt financing while the bottom curve includes that minus the costs of bankruptcy. This is equivalent to the 800000 interest expense multiplied by 35. Trade-off theory of capital structure.

You are required to finish each of these questions each worth 10 marks total 40 marks. Deduction such as amortization charitable contribution depletion depreciation medical expenses mortgage interest and un-reimbursed expense that reduce a taxpayers income tax liability. Nói chung hội hợp tác không là tổ chức phải nộp thuế.

Interest tax shield là gì. Cost of debt is used in WACC calculations. Thuế thương vụ thông thường được đánh thuế tại điểm bán được thu bởi nhà bán lẻ sau đó chuyển cho chính phủ.

Definition - What does Interest tax shield mean. As such the shield is 8000000 x 10 x 35 280000. Lý thuyết CF brief CourseCorporate Finance 200426 1.

Tax Shield là gì. Money taken from a persons income and paid directly to the government by their employer 2. Definition - What does Tax shield mean.

Tax benefits derived from creative structuring of a financing arrangement. Please give the solutions in detail show calculations and submit the solutions to Moodle using a single file it can be Excel format Word format or PDF format no requirement on word limits if use any referen. Có thể Interest tax shield là gì.

Món lợi tức tiền lời thua lỗ những khoản khấu giảm và tín thuế của hội hợp tác đều được dồn chuyển cho các bên hùn hạp dựa trên phần phân chia của mỗi bên từ những mục này. Có thể Interest tax shield là gì. Lợi Tức của Hội Hợp Tác.

Withholding tax ý nghĩa định nghĩa withholding tax là gì. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable donations amortization and depreciation. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest Deduction As Mortgage Interest Mortgage interest deduction refers to the decrease in taxable income allowed to the homeowners for their interest on a home loan taken for purchase or construction of the house or any borrowings.

Tax Deduction The government allows certain types of income or expenses to be deducted from total taxable income for example Student loan interest traveling etc. Flightradar24 For Tracking Flights With Live Tracking Maps Information On Aeroplane Types Flight Status And Live Informa Fligh. Thuế thương vụ trong tiếng Anh là Sales Tax.

Thuế lợi tức thuế thu nhập. Còn là biểu giá như giá điện giá thuê nhà. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible.

Interest is a reduction to net income on the income statement and is tax-deductible for income tax purposes. For example if youre in the 24 tax bracket and you have 1000 in tax-deductible interest youll save 240 on your tax bill. This reduces the tax it needs to pay by 280000.

CAPM để làm g ì-Risk free rate-Beta of the security -Market risk premium dif ference between expected return on market and risk free. Interest payment tiền lãi phải thanh toán interest period điều kiện ngang giá tiền lãi interest statement bản báo cáo tiền lãi interest suspense sự ghi tạm tiền lãi nominal interest tiền lãi thực rolled-up interest tiền lãi lũy kế tax on deposit interest thuế tiền lãi gởi tax-deductible interest.

Paid In Kind Pik Interest Formula And Calculator Excel Template

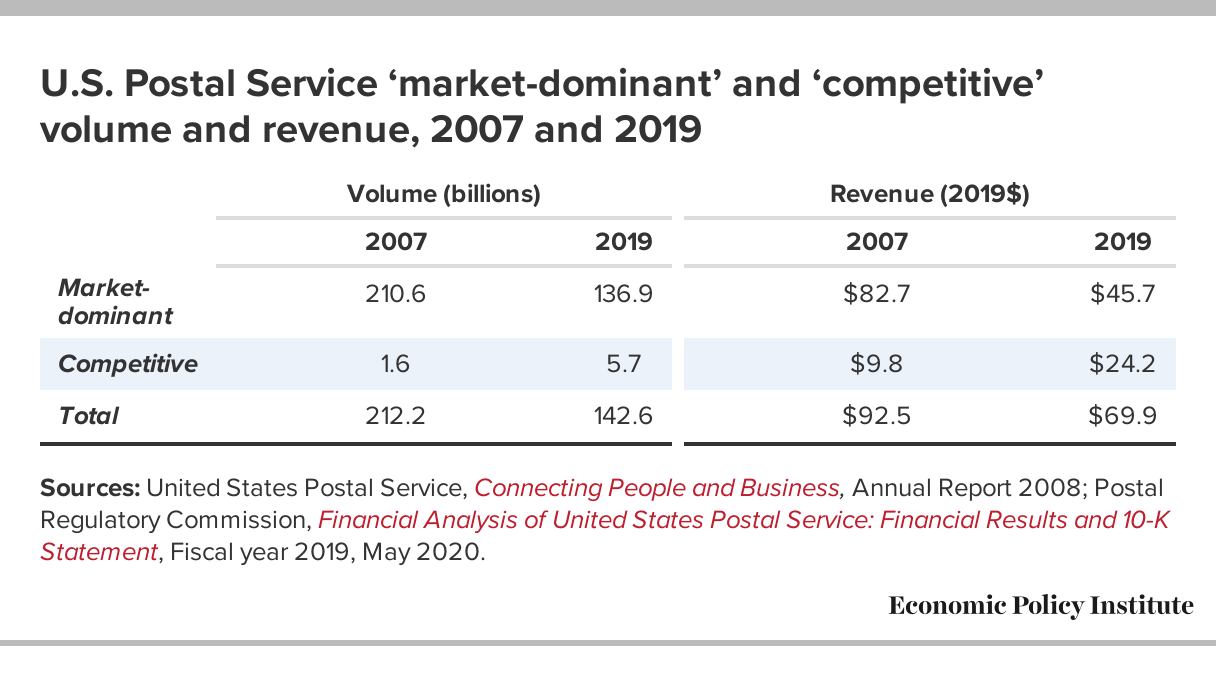

The War Against The Postal Service Postal Services Should Be Expanded For The Public Good Not Diminished By Special Interests Economic Policy Institute

Paid In Kind Pik Interest Formula And Calculator Excel Template

Workshop 2 Week 13 Questions Capital Budgeting And Valuation With Studocu

Pdf Determinants Of Financial Capital Use Review Of Theories And Implications For Rural Businesses

Amazon Com Yu Gi Oh Gagaga Shield Ztin En005 2013 Zexal Collection Tin 1st Edition Ultra Rare Toys Games

Workshop 2 Week 13 Questions Capital Budgeting And Valuation With Studocu

Tax Consultant Deloitte Us Careers

Paid In Kind Pik Interest Formula And Calculator Excel Template

Workshop 2 Week 13 Questions Capital Budgeting And Valuation With Studocu

Apply My Tax Refund To Next Year S Taxes H R Block

Difference Between Opportunity Cost And Trade Off Difference Between

La Chắn Thuế Tax Shield La Gi Y Nghĩa Của La Chắn Thuế

La Chắn Thuế Tax Shield La Gi Y Nghĩa Của La Chắn Thuế

Student Debt Is Transforming The American Family The New Yorker