tax on forex trading nz

Is my gain from foreign currency trading counted as capital gain. If you are eligible well pay it into your bank account.

Forex Trading Academy Best Educational Provider Axiory

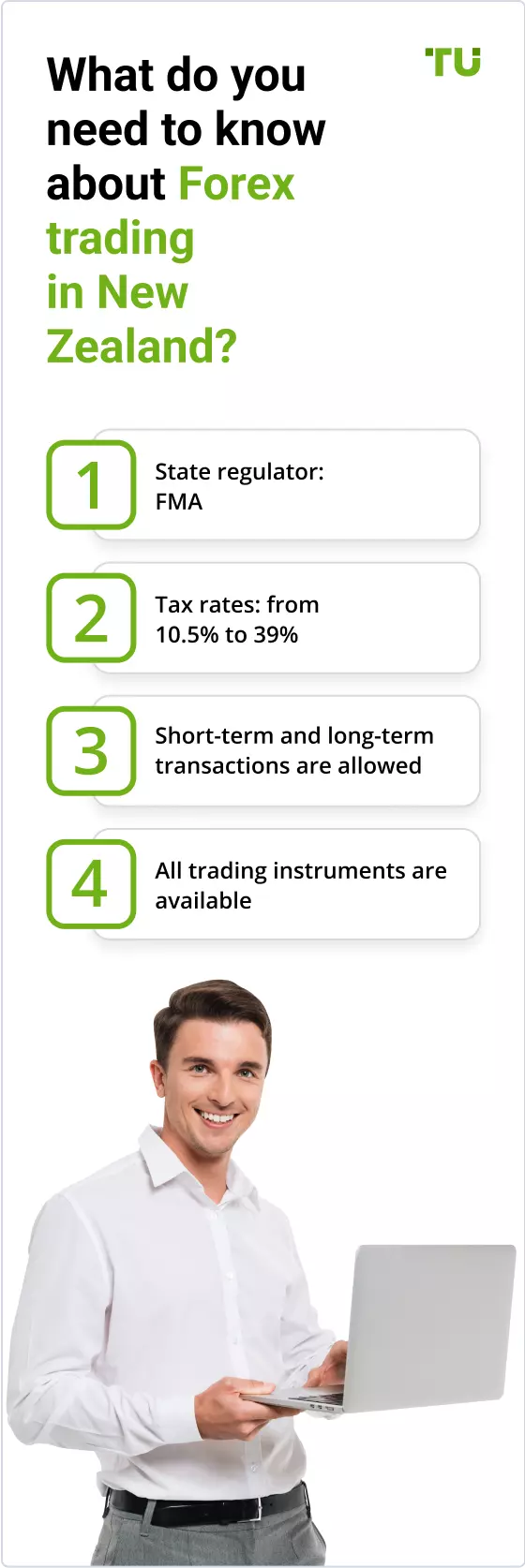

Before any fx broker in New Zealand can accept forex or CFD traders as clients they must become authorised by the Financial Markets Authority FMA which is the financial regulatory body in New Zealand.

:max_bytes(150000):strip_icc()/dotdash_final_Forex_Market_Hours_Dec_2020-01-85c0a7fa11a347f8937001cc596a13cc.jpg)

. Forex trading is the buying and selling of foreign currencies. Unfortunately its a situation where the tax system could be accused of taxing gains in a. If you trade CFDs then you are subject to capital gains tax CGT on.

Is IRD chasing those individual traders. If trading in forex is a business for the trader the income arising from it will be taxed as business. Hi I am planning to trade in NZX ASX AND FOREX MARKET.

Why companies are taxed over individuals. So even if your broker and Forex trading in another country you may still be taxed depending on your country laws. Ad Nous avons verifié tous les courtiers Forex.

Evans Doyle 2 Kirkwood Street Cambridge 3450 020 4122 4440 timevansdoyleconz. We recommend NZ residents also follow the FMA. Contact us to ensure you are prepared for tax and have the right strategy in place.

Tell your provider that is your bank fund manager or financial. Forex futures and options are 1256 contracts and will be taxed according to the 6040 rule. The rate that you will pay on your gains will depend on your income.

If your total income is. Cryptoassets that are not part of your trading business. Spot forex traders are considered 988 traders and can deduct.

But the question is is it taxable. Trading CFDs as your main source of income will also mean you are liable for income tax. But I dont know if I should pay taxes on my gains.

In New Zealand individuals or businesses offering these contracts must hold a derivatives issuer license from FMA. Most Countries consider it as Capital Gains Tax. The pairs currencies are traded in are standardised.

A derivative product involves trading in the changing value of an underlying asset such as currencies shares bonds commodities or interest rates. Forex Trading Tax Nz Unrealised Forex Gain Tax Treatment Realized And Unrealized Gains At What Point Does A Stock Trader Need To Pay Tax On Profits Tax Pepperstone Forex Trading Master The Trade With Pepperstone How To Trade Forex Forex Trading Examples New Zealand Forex Trading Tax Forex That Accept. Trading forex currencies in New Zealand NZ is popular among residents.

Im trying to do online FX trading and really confuse with the tax. Nous avons comparé tous les courtiers Forex. If the trading activity is performed through a spread betting account the income is tax-exempt under UK tax law.

Tax on forex trading nz. Nous avons comparé tous les courtiers Forex. In New Zealand individuals or businesses offering these contracts must hold a derivatives issuer.

Forex trading is the buying and selling of foreign currencies. Forex trading is conducted using currency pairs such as EURUSD NZDUSD or NZDAUD. Are taxed on the basis of their applicable income tax rates or capital gains tax.

Even if youre not a trader youll still need to pay tax on any gains if you bought your cryptoassets for the purpose of selling or exchanging them. Choisissez le meilleur broker. There is no tax on the gains from investing in New Zealand and most Australian shares.

Choisissez le meilleur broker. Ad Nous avons verifié tous les courtiers Forex. The rate changes because either one of the currencies appreciated or one of them.

While there are different types of cryptoassets the tax treatment depends on the characteristics and use of the. The tax rate is 33 of the trading income. Tax rates of exchange.

Despite the fact that New Zealand does not have a Capital Gains Tax there are circumstances where gains made can be taxed as income. Indirect tax meanwhile could be the Goods and Services Tax GST Securities Transaction Tax STT or stamp duty. New Zealand does not have a broad capital gains tax regime like many other countries however some gains are taxed as income or trading profits.

60 of gains or losses will be treated as long-term capital gains and the remaining 40 as short-term. Paypal Cryptocurrency Investors Reminded Of. Forex Trading NZ - Best Forex Brokers Regulation Taxes In this.

Aspiring forex traders should consider tax implications before getting started on trading. Mar 13 For tax purposes forex options and futures contracts are considered IRC Section contracts which are subject to a 6040 tax consideration. - The Tax On Forex Trading New Zealand trading platform should be accessible on mobile devices to enable you to trade on the go.

In the simplest sense to make money trading forex you need to predict which of the two currencies in a trading pair will appreciate against the other. Comparez et commencez à trader. We provide tailored and proactive cryptocurrency tax advice to all clients anywhere throughout New Zealand.

Direct tax is income tax that is imposed on the profits made from forex transactions. If you fall into the tax bracket it. Interest payments and profits from trading when conducted as a business are likely to be subject to income tax from 20 to 45 while other taxable profits are generally taxed as a capital gain at 10 or 20.

20-30 dollars gain in a week is very small. The tax on forex trading in the UK depends on the instrument through which you are trading currency pairs. It is important to find out under which of these categories you will be taxed.

If youre a trader you might have some cryptoassets that are. You need to choose the correct tax rate or you could face an unexpected bill at the end of the tax year. Yet losses can be declared for tax relief purposes.

Forex traders found liable to personal taxation on their trading profits in the UK. Once your main source of income is spread betting then you will be liable for income tax. Returns can come from purchasing foreign money that will need to be held in a foreign currency bank.

Forex futures and options are 1256 contracts and taxed using the 6040 rule with 60 of gains or losses treated as long-term capital gains and 40 as. People trade in forex either to try to make a quick profit by betting on the changing value of a currency or to provide certainty about the cost of future foreign currency payments called hedging. So the gainslosses you make will be taxable income in your own name and added or deducted if a loss against your other income eg PAYE income and then taxed at your marginal rate.

But the question is is it taxable. The FMAs website is fmagovtnz. You can fall under spread betting or you can trade contract for differences CFDs.

Comparez et commencez à trader. Cryptoassets are treated as a form of property for tax purposes. Tax on gains made may apply to NZ investors when.

Forex trading using contracts linked to the exchange rate between two currencies is classed as trading a derivative financial product. We regularly receive complaints and enquiries from consumers who have lost. 60 of the gain is treated as a long-term capital gain at a rate of 0 if you fall in the tax bracket.

This makes CFD trading tax efficient if it is your main source of income. I cant find any guides in the IRD website that would assist me on how much should I pay. Is IRD chasing those individual traders.

The main way to tell if youre in the business of. They purchase a property with the intention to sell it this rule was introduced in 2016. All NZ citizens and residents pay either Resident Withholding Tax RWT or tax at the Prescribed Investor Rate PIR on income from savings and investments in New Zealand.

Does Your New Share Market Habit Come With A Tax Bill Tax Alert November 2020 Deloitte New Zealand

Forex Trading Nz Best Forex Brokers Regulation Taxes

Chapter 11 Forex Trading Aud Nzd Spot Forex Example My Trading Skills

Which Country Is Best For Forex Trading

Five Important Facts About Online Forex Trading In New Zealand Otago Daily Times Online News

Forex Trading Nz Best Forex Brokers Regulation Taxes

Forex Trading Academy Best Educational Provider Axiory

Forex Trading Nz Best Forex Brokers Regulation Taxes

Forex Trading Nz Best Forex Brokers Regulation Taxes

Forex Trading Academy Best Educational Provider Axiory

6 Best Forex Trading Brokers New Zealand 2022 Fma

Forex Trading Nz Best Forex Brokers Regulation Taxes

Forex Trading Nz Best Forex Brokers Regulation Taxes

Forex Trading Nz Best Forex Brokers Regulation Taxes

Wikifx Report What Is The Average Profit In Forex Trading News Wikifx

/dotdash_final_Forex_Market_Hours_Dec_2020-01-85c0a7fa11a347f8937001cc596a13cc.jpg)